Export customs clearance

The customs procedure for export is a regime that provides for the movement of goods produced in the Russian Federation outside its territory for the purpose of permanent residence in another country or sale.

Employees of the broker "Kwando-Terminal" will help clients avoid financial losses and save time by taking over the work with customs. You can order full customs clearance of the export of goods or the implementation of individual stages - from a set of declarations and its successful electronic submission to logistics services.

Customs clearance of export from Russia and its features

Export clearance is largely determined by the following characteristics of goods:

- by type;

- functional purpose;

- physical parameters;

- country of destination.

The Commodity Nomenclature of the TN VED determines the codification of groups of goods for export. Each individual batch and type of product receives a specific risk profile established by the customs authorities in accordance with the classifications and provisions of this regulation. Taking into account this profile and applying certain methods, the customs performs clearance, inspection and declaration, determines the amount of payments, duties and the release process.

In accordance with Article 18 of the Labor Code of the Russian Federation, customs payments include the collection for the issuance of licenses, duties, taxes and fees. Their collection is regulated by the sequence agreed by the law, and the customs authorities of the Russian Federation during the registration process control payments.

On the part of customs, additional controls may be applied to some product groups. These include:

- industrial equipment - products can be included in the list of dual or military goods. In this case, the Federal Services (FSTEC and FSMTS) will be required to provide permits;

- products with a registered trademark - the trademark owner must provide permission to export the goods;

- goods from foreign manufacturers - a customs declaration will be required, on the basis of which the procedure for release for domestic consumption when imported into the Russian Federation (import 40) was drawn up.

Sequence of actions for customs clearance of export

- Pre-declaration. This stage includes the preparation of the declaration and its submission in electronic form before the arrival of the goods at customs. A preliminary declaration significantly speeds up export processing, it provides customs officers with information about the time of arrival of the goods, about the type of goods and their quantity;

- delivery of exported products to the place of control with simultaneous forwarding to the customs office of the GTD (cargo customs declaration) and other shipping documentation;

- payment of mandatory payments, fees and duties based on the data provided by the declaration;

- sending documents to customs officers for inspection and providing cargo for inspection;

- release by customs. The cargo is allowed for export with the correct execution of the necessary documents, timely payment of payments and in full, provided that the consignment of goods corresponds to the data specified in the documents. The cargo is picked up from the temporary storage warehouse and delivered to the consignee abroad.

A customs broker can perform competent export clearance. The company "Kwando-Terminal" will assist in the fast customs clearance of products for export, will help to organize export with minimal risks, optimize the terms and amounts of payments.

Required Documentation

- Foreign economic contract, which is concluded between a supplier from Russia and a recipient of cargo abroad. It is the main document for the transaction and defines a number of its conditions. Its content has a direct impact on the procedure for customs clearance.

- For contracts exceeding $ 50,000, a deal passport is provided to ensure currency control.

- Declaration containing basic data about the exported consignment.

- Invoice - an invoice containing a list and quantity of goods, details of the participants in the transaction and other data.

- Transport documentation - it depends on the transport that will be used to deliver the goods (rail waybill, air waybill, freight transport and bill of lading).

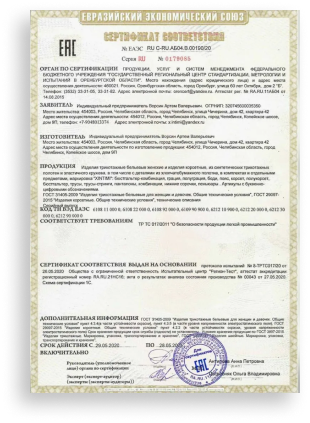

- Additional documentation, which depends on the assigned TN VED code. Some categories of goods must have sanitary and epidemiological conclusions, permits, licenses, certificates.

Why is cooperation with Kvando-Terminal an optimal solution?

- Experienced professionals will help expedite export clearance by providing pre-declaration and accompanying control procedures;

- you get a guarantee of correct paperwork, certification, licensing and classification according to the Foreign Economic Activity Commodity Nomenclature;

- mandatory payments and other foreign economic activity costs will be optimized as much as possible - the company's specialists will help to reduce the amount of fees and duties, eliminate delays and reduce risks to minimum values, effectively plan logistics.

Apply for the service, we will contact you as soon as possible and answer all your questions.

Cost of services

| # | Service name | Cost | Term |

|---|---|---|---|

| 1 | Import customs clearance | from 15,000 rubles | from 1 day |

How will we work

Feedback from our clients

Leave a request for calculation or consultation

Apply for the service, we will contact you as soon as possible and answer all your questions.